Deposits - how much will i need?

Deciding to buy a property is an exciting prospect, but it first involves navigating various financial aspects, one of which is whether you'll need a deposit, and if so, how much you will need.

Here are some AskJoanna tips

Here are some AskJoanna tips

understanding the basics

What is a deposit?

A deposit is a lump sum of money paid by the buyer to the seller (via the property lawyers) as a commitment to purchasing the property.

It serves as security for the seller, protecting them against the buyer pulling out of the sale without a valid reason.

What are the different types of Deposits?

Reservation Deposit

This is an initial deposit paid when an offer on a property is accepted. It's typically a small amount, between £250 and £1,000, and only relevant to new build purchases.

Exchange Deposit

The exchange deposit is a more substantial sum, usually 10% of the property's purchase price. It is paid upon the exchange of contracts exchange, and is held in a secure account until the completion of the sale.

The exchange of contracts is a crucial milestone in the property-buying process. At this stage, the buyer is legally bound to purchase the property, and the deposit becomes non-refundable except in specific circumstances outlined in the contract.

Read our blog Exchange & Completion

Things to note:

If you are selling and buying at the same time, the deposit is usually passed ‘up the chain' i.e. you would use your buyer's deposit to put towards the property you are purchasing

Although 10% is the typical exchange deposit amount, it can be less than this if it is negotiated between the parties. For example, the buyer's deposit for your sale may be less than 10% of the purchase price of property you are buying. If it is agreed, the lawyers will just hold less than 10%. If it is not agreed, you'll need to make up the shortfall.

Generally speaking, if the exchange deposit is less than 10% it is likely to be agreed by all parties as it is more common these days for first time buyers to have only 5% deposit. There is a legal obligation to pay the balance of the purchase price (i.e. the amount remaining less the deposit) so no party is at loss if a small deposit is held. The deposit is not intended to be on top of the purchase price.

If you are purchasing a high value property i.e. £1 million + it may be necessary to provide proof of funds which would include at least a 10% deposit and in addition the amount of stamp duty payable. You may also have to deposit this money in an escrow (deposit) account with the lawyers and/or the estate agents at the time your offer is accepted.

How much Deposit do I need?

The starting point would be 5% because only in very rare circumstances would a mortgage lender lend 100% of the purchase price. Lenders are currently offering 95% mortgages making things more affordable, especially for first time buyers.

But there are many other things to think about and factors that will influence the amount of deposit you need:

The purchase price of the property – of course the higher the price, the higher the deposit required. If you want to buy a property that is £200,000, you will need a £10,000 deposit as a minimum.

The amount of mortgage - what will a lender agree to lend to you? Again, based on the property being £200,000 and you paying a 5% (£10,000) deposit, the lender would need to agree to lend £190,000. Lenders typically offer a loan of up to four-and-a-half times your annual salary – you'd need to earn at least £42,222 salary per year based on this example.

The rates and deals offered by lenders - the higher your deposit and the smaller % the lender is loaning, the better the deals.

Affordability checks - whether you can afford the mortgage repayments, based on your income and outgoings. With a small deposit, it's more likely you will fail these checks because you'll need to spend more on your mortgage each month. The bigger your deposit, the lower the mortgage repayments.

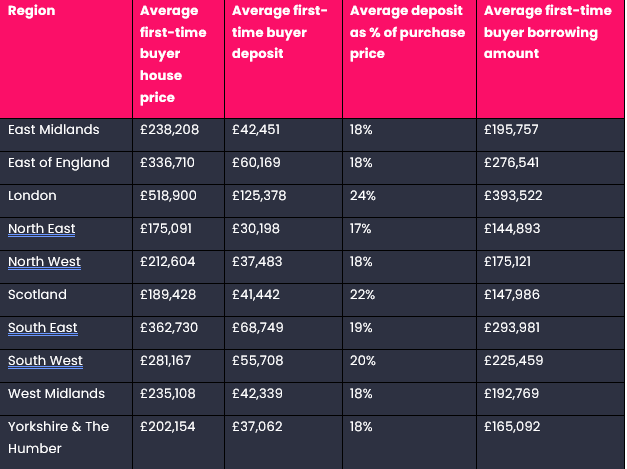

This is a summary of average deposits in 2022/23 published by the Halifax. You can see the average deposit is at 18%. This is probably due to affordability i.e. needing a bigger deposit to allow for an affordable mortgage loan and repayments.

But don't fear - this does not mean you will also need 18% deposit and that a 5% deposit is out of the question. The good news, particularly for first-time buyers, is there are many Government Schemes and Developer incentives to help you along the way. It's worth checking out all the options that could be available to you.

Here's a little bit of information about some of the schemes and incentives that are on offer:

First Homes scheme - allows first-time buyers in England to get a 30% discount when buying a new-build home. A developer and the local Council can set their own eligibility rules – but the first step would be to contact the developer and tell them you are keen to buy under this Scheme.

Lifetime ISA - a tax-free savings or investment account designed to help those aged 18-39 save for their first home or retirement. It offers a 25% bonus, with the government paying up to £1,000 a year if you save the maximum £4,000. The maximum house purchase price is limited to £450,000.

Shared ownership - you buy a share of a property (usually from 25%) and pay rent on the remainder. This allows you to get a foot in the door, but you'll need to do your sums, as the combined cost of your mortgage, rent and service charge can quickly add up.

Guarantor mortgages - parents (or even grandparents) can help buy a home by using their property or savings as the security needed to gain a mortgage.

Incentives offered by developers - there are many different types offered, like a deposit unlock, deposit boost, cash back, parent power, shared ownership, part exchange. Check out offers from developers like Barratt Homes.

Always start with preparing a financial budget when deciding to buy your property. The deposit is a big part of this budgeting, although definitely not the only thing to consider. There are some helpful tools and calculators in our How to Buy a Property Guide and you can also search for a deposit calculator online that will help you calculate how to save more, if this is necessary.